The Cat is Out of the Bag.

US Housing Market Headed for the Deep Freeze

"After five adrenaline-pumping years of real estate sales, 2006 is already fulfilling predictions of a weaker market."

"January should have been a hot month to sell new homes. Record warmth for much of the country kept construction crews busy and was expected to entice prospective buyers to come out to shop, economists said. Instead, America's housing market went into the deep freeze. And that has some worried there may be trouble down the road for several sectors of the economy."

"Though many analysts say the market is undergoing the expected cooling off after five years of red-hot sales, some are worried about the slowdown's dual effect, first on construction and then on consumption. Consumers who have seen the price of their houses double in the last few years have used equity built up in the homes to help power the country's economic engine."

"If home prices flatten out--and we are expecting that--it has a slowing effect on the economy," said Ed McKelvey, a senior economist at Goldman Sachs in New York.

The Commerce Department said sales of new homes dropped 5 percent in January to their slowest pace in a year while the number of new homes on the market hit a record high.

"A record number of new homes, 528,000, are sitting waiting for buyers. At the current sales pace it would take 5.2 months to sell that inventory--the longest time since 1996."

"Inventories of existing homes climbed in January by 2.4 percent, leaving 2.91 million homes available for sale at the end of the month. That equates to 5.3 months' supply at the current sales pace, the highest since August 1998."

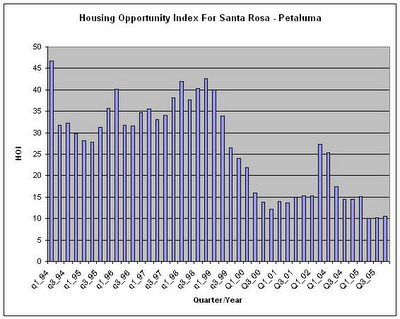

"The figures were the just the latest in a string of data pointing to a cooling in the U.S. housing market after a five-year rally that shattered sales and construction records, and sent prices soaring more than 55 percent across the country."

"Builders are seeing more orders canceled. Meanwhile, the number of homeowners who are late paying their mortgages has been creeping up. For subprime borrowers — those with impaired credit who carry higher-interest loans — the number of delinquent loans has jumped to nearly 10%."

"Horsham, Pa.-based Toll Brothers Inc., one of the nation's biggest home builders, said last week that its first quarter-end backlog rose 22 percent and signed contracts declined 21 percent compared with the company's record first-quarter results last year."

"One in five builders said they are seeing more cancellations of new-home orders than they did six months ago, according to the National Association of Home Builders, with 4% saying the problem is significant."

"To entice home shoppers, many builders are offering free TVs, swimming pools, landscaping and other incentives."

“The inventory of homes for sale could swell as new homes nearing completion come on the market, and as home owners who believe mortgage rates will head higher rush to list houses before financing tightens, said Bob Edelstein, co-chair of the Fisher Center for Real Estate and Urban Economics at the University of California, Berkeley.”

"The backlog of unsold homes will put real downward pressure on prices over the next few months," despite a January rebound, raising mortgage rates and depressing future sales, said Ian Shepherdson, chief U.S. economist at High Frequency Economics."

“‘We have now seen three months in a row where sales have dropped more than expected,’ said Robert Kleinhenz, an economist with CAR. ‘At least some home buyers have adopted a wait-and-see attitude.’”

"One key reason fewer people are buying: They can't afford to. The median price — half cost more, half less — was unchanged from December."

“‘Mortgage brokers are not as busy, real estate brokers are not as busy,’ said Kevin Clay of a San Carlos-based real estate and financial services firm. ‘There seems to be a decrease in activity overall.’”

"Home prices have gotten a little frothy, as [former Federal Reserve Board Chairman Alan] Greenspan said," noted Carl Tannenbaum, chief economist for LaSalle Bank, but that is mainly true in California, parts of the Northeast and Las Vegas.

"The housing market is certainly shifting away from a record-breaking pace," said Lawrence Yun, senior economist for the Realtors."

"The data showing a slower-than-expected sales pace contributed to a drop in U.S. stocks (^DJI - news) and the dollar on Tuesday, while Treasury bond prices rose. Shares of housing-related stocks also traded lower."

"According to the Realtors, home sales were easing in the priciest markets where an increase in mortgage rates will have the biggest effect on buying power. Sales dropped 10 percent in the Northeast, 7.7 percent in the Midwest and 3.5 percent in the West."

"January was not a good month for home sales in Sacramento or the state, according to a report released Tuesday by the California Association of Realtors. In Sacramento, 31 percent fewer homes were sold in January than in December, a mark that was also 32.4 percent below January 2005."

"CAR vice president and chief economist Leslie Appleton-Young said in a statement. "The number of homes for sale has risen to a six-month supply, which will translate into a slower rate of price appreciation than we experienced in 2005."

"Fran Floyd took her Houston townhome off the market Saturday after nearly six months — even though she was willing to sell it for $3,400 less than she paid in 2002."

"It's just sad," said Floyd, 81. "I've got to sell. I don't know what I'm going to do. What I'm thinking about and praying about is renting it for a year, hoping the real estate market gets better."

"We've just got tons of inventory," and prices are coming down in Grand Rapids, Mich., said Pat Vredevoogd of AJS Realty.

"The writing seems to be on the wall at this point," said Chris Low, chief economist at FTN Financial in New York. "Prices are .. falling. Meanwhile, the supply continues to rise."

214 listings for Sonoma

25 houses sold last month

53 with price reductions

For more information on the links between how much money we make, spend and save in the US visit: The Mess That Greenspan Made and check out the solid article titled 'Income, Wealth, and Debt'

Stay tuned for more data from: The Office of Federal Housing Enterprise Oversight (OFHEO) 4Q 2005 Housing Price Index numbers will be released at 10am EST today.

Also in the news another REIT hints it may have some trouble brewing...

“Saxon Capital, Inc., a residential mortgage lending and servicing real estate investment trust (REIT), today announced it is delaying its 2005 fourth quarter and year end earnings press release and related conference call. The Company expects to report its complete operating results on or before March 31, 2006.”

“Management is reviewing the..derivative transactions used in its hedging strategy to manage interest rate risks from 2001 to the third quarter of 2005. If the Company determines that it did not meet the requirements of SFAS 133, a restatement of results from 2001 to the third quarter of 2005 may be required. ‘We are disappointed in this delay, but need more time to review these complex accounting issues before reporting our results,’ said Michael Sawyer, CEO of Saxon. Robert Eastep, CFO of Saxon said, ‘In light of recent scrutiny as to the application of hedge accounting, we are reviewing our accounting treatment of our derivative transactions related to our hedging strategy to ensure that our financial statements adhere to SFAS 133.”

“The Mortgage Loan Operations segment originates, purchases, and securitizes primarily nonconforming residential mortgage loans.”

“In the wake of the prime lending sector’s refinance contraction, the nonprime sector has picked up and become more mainstream, accounting for 28% of total loan originations, according to a panel member at the MBA Expo in Phoenix. Michael Drawdy, senior vice president at Countrywide Financial Corp., said half of subprime ARMs will be due in the summer and over the next 14 months. ‘There will be some people who can’t pay for an ARM change,’ Mr. Drawdy said.”

“‘That is why you must make sure there is a system in place for collections, to make sure borrowers know their options.’ Panelists talked about repayment plans and ARM modifications aimed at helping borrowers stay in their homes. Over the next 12-24 months, there is a potential for severe delinquencies, they said.”