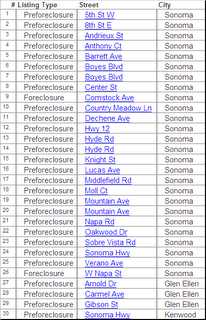

What Direction? .... Down

Also from the Press Democrat- "The Commerce Department reported Wednesday that home sales increased by 4.1% last month, the best showing since an 8% increase in March."

"But even with the increase, the median price of a new home fell to $237,000, a drop of 1.3 percent from August 2005. It was the first year-over-year price decline since late 2003."

'"August is just a blip. Housing is still headed down," said Mark Zandi, chief economist at Moody's Economy.com."

'"Everything still points to continued weakness in sales, construction and home prices."'

"Many analysts said the government statistics understated the drop in new home prices because they don't pick up heavy discounting that is under way as builders offer incentives such as kitchen upgrades and free landscaping to move unsold homes."

"Earlier, it was reported that sales of existing homes fell for a fifth straight month in August while the median price of an existing home dipped on a year-over-year basis for the first time in more than a decade. Also, construction of new homes and apartments plunged by 6 percent in August."