From SFGATE.com

From SFGATE.com - "...a real estate agent called me. "I think I have a scoop for you," he told me, his voice vibrating with gumshoe grit. He'd heard that a prominent East Bay company was training its agents to inflate properties by $50,000 to $150,000, then have sellers return the cash after the close of the deal. Unlike the arrangement with the developer, these deals were concealed from lenders by adding the cash-back arrangement onto an addendum apart from the purchase contract."

"How did my friend hear about this practice? A local manager of a prominent real estate company had tipped off my friend's broker over lunch. The manager, who had been shocked at the behavior, had then gone back and looked at his own agents' files to see whether the practice ever happened in his own office. "The guy said he found so many in his own files in the past couple weeks, he didn't want to look anymore," my agent friend said."

"What exactly was happening here? The developer didn't think he was doing anything illegal, and the broker had no idea the inflation was happening under his watch. But in both cases, everyone involved probably would have been considered at least partially culpable if the lenders could mount a case that they were being deceived."

"Welcome to the convoluted world of mortgage fraud, a crime in which it's sometimes hard to disentangle victim from criminal, and crime from business as usual."

"Why? In the years of booming appreciation and bargain-basement interest rates, real estate has become a national obsession. With it have come certain run-of-the-madness practices. Appraisers agree to inflated property values. (By next month, the market will go up so much, they'll be valid.)"

"Agents write offers with increasing amounts of cash back. (How else can the poor homeowners get that Viking range?) Mortgage brokers play the "we'll get you that loan no matter what" game of social engineering. (How else can schoolteachers buy a home?)"

"But now the proverbial vultures have come home to roost -- mortgage fraud is being busted left and right. This month, the most spectacular example so far was reported in the Wall Street Journal: an $80 million federal grand jury case involving more than 100 homes in Indiana."

"Also, last year, one of the largest property owners in Buffalo, N.Y., was convicted of perpetrating a $4 million fraud-for-profit scheme, sentenced to a year in prison and slapped with a $1.5 million fine. Last July, the New York Times reported on the precipitous rise in mortgage fraud, quoting the FBI that lenders lost an estimated $1 billion last year, double the previous year's estimate, from mortgage fraud. (For a thorough list of recent cases, visit

MortgageFraudBlog.com.)"

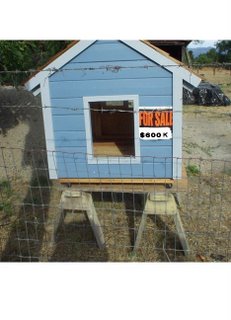

"Recently, a developer regaled me with a story about a house that seemed to be cursed. Although he beautifully renovated it and priced it below market, the Oakland bungalow just wouldn't sell. Deals fell through repeatedly for bizarre and unrelated reasons: Buyers got cold feet, or moved -- one was even arrested. By the time the fourth deal collapsed, the developer was in an acute state of financial panic. "

"So, when one of the mortgage brokers who had helped a previous prospective buyer called with a new one who would close the deal for -- get this -- $100,000 over the asking price, he naturally jumped at the offer. "

""The catch was that I had to give the $100K back to them after the close of escrow," the guy told me, still looking shell-shocked. "I couldn't understand why they would want to do that. The place was completely remodeled." (Most buyers who get cash back after escrow pour that money into repairs. Typically, though, lenders like to keep this amount to no more than 3 percent of the purchase price.)"

"The developer went through with the sale, wondering what his buyers (whom he never met) were up to. Because he wasn't lying about anything -- everything was disclosed on the purchase contract -- he didn't feel he was doing anything wrong. "

"As crimes go, mortgage fraud is hard to get riled up about. In many cases, the victims are institutions that earn billions of dollars a year. Even the banks have colluded in creating products, such as negative amortization and stated-income loans, that sometimes seem to encourage irresponsible borrowing. And straw buyers may claim they are victims, but, let's face it, they were motivated by the promise of easy money, so they are also perpetrators. (Of course, those whose identities were stolen are innocent.)"

"Whatever the case, it's important that we don't allow mortgage fraud to continue as one of those little illegal real estate things everyone does. Just as credit card fraud ends up on all our monthly bills, homeowners end up paying for lenders that get defrauded. As the saying should go, there is no free mortgage."